|

Vania Franceschelli Vania Franceschelli

Member of FECIF Board of Directors & Foreign Affairs, ANASF

MiFID II costs disclosure. Nothing is flawless, not even regulation

On March 28, ESMA, the European Securities and Markets Authority, updated its Questions and Answers (Q&A) document on the implementation of investor protection under MiFID II. The periodic update of the Q&As can be appreciated from different points of view. First, it provides an ongoing and flexible tool for the clarification of the application of EU rules. Moreover, it is based on a bottom up approach, whereby market operators can address specific and practical questions to the financial authority. And, more importantly, it contributes to the harmonisation of market practices. But nothing is flawless, not even regulation (and its interpretation). Let’s examine some of these Q&As and try to identify pros and cons.

Before the event

An important part of the recent update covers the topics of information to clients on costs and charges, providing useful hints for investment firms and financial advisors. With regards to ex-ante disclosure – i.e. the information which shall be provided prior to the provision of the service or the execution of a transaction – the Q&As make it clear that generic information is not sufficient. Investment firms are thus required to provide fully individualised, transaction-based information in relation to the specific service and financial instrument (the so-called ISIN-based approach, from the name of the international code for the identification of securities). At the same time, ESMA acknowledges that, before the transaction, the exact amount of the transaction may not be known yet; in this case investment firms are allowed to disclose costs considering an assumed investment amount, provided that the calculations reflect the costs the client would actually incur on the basis of the assumed amount. This clarification has the immediate advantage of offering investment firms the possibility to easily comply with the rules on ex-ante disclosure. Nonetheless, it is also important to ensure complete information and comparability among different investment solutions: from this point of view, something is missing. For the sake of comparability, the regulator should have recommended using some specific assumed amounts (for instance, 10,000 or 100,000 euros), as already happens with the Key Information Document (KID) for packaged retail and insurance-based investment products (PRIIPs), where costs are shown assuming that a lump sum of 10,000 euros (or a regular premium of 1,000 each year) is invested.

And afterwards…

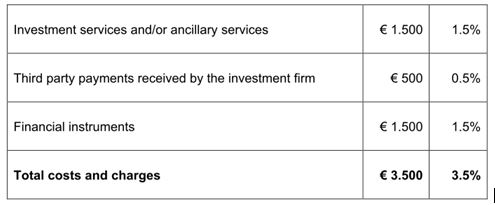

Moving to ex-post disclosure, in 2017, on the occasion of a previous update of the Q&As, ESMA published an example, in the way of the table shown below, of the aggregation of costs and charges for investment services and financial instruments (in accordance with MiFID II provisions, third party payments shall be itemised separately). It is important to remember that the aggregated costs and charges shall be totalled and expressed both as a cash amount and as a percentage.

Source: ESMA Q&A

Also, in this case, the solution envisaged by ESMA contributes to clarity and harmonisation, but something important is still missing if we consider that the table presented in the Q&A does not specify the basis for the calculation. Shall the percentages be applied to the average invested amount over the year? This could be the case but, in the absence of specific guidance, different investment firms may apply different bases and methodologies for cost calculation. Again, it is difficult to strike an effective balance between harmonisation and comparability, on the one hand, and proportionality and organisational autonomy, on the other.

In addition, the investment firm shall provide an itemised breakdown at the request of the client and should also take reasonable steps to minimise the effort for the client to submit such requests. In accordance with MiFID II provisions, the cost items shall specify one-off and ongoing charges, all transaction costs, charges related to ancillary services and performance fees. The Q&As explicitly allow investment firms to add their own “commercial” terminology, but commercial terms should be clearly defined with reference to the MiFID II official terminology. The same reasoning explained above applies: where is the equilibrium between regulatory compliance and market freedom?

Taxation issues

Finally, the new update from ESMA considers the inclusion of taxes in costs and charges disclosure. A distinction is made between transactional or service-based taxes related to the provision of the service (such as stamp duty, transaction taxes or VAT), and taxes on the income or revenue generated by the investment. While taxes related to the provision of the service should always be included in the disclosure – as they are explicitly listed in the MiFID II Delegated Regulation – it is up to the firm to decide whether to include, or not, in their disclosure the taxes on income or growth. Again, it is extremely difficult to achieve the right balance between market freedom (investment firms may choose the taxes to be disclosed), on the one hand, and harmonisation, on the other (the investor is disclosed the same cost items by different firms). This last example represents the most critical case of all the instances we have mentioned, as it pertains to a difficult and sensitive field, i.e. taxation.

It is possible that, in the near future, new Q&As by ESMA (and new requests for clarification by market operators) will provide further guidance and try to solve the issues which are still unclear. For the time being, it can be said that it is true that nothing is flawless, but all market stakeholders (authorities, financial intermediaries and advisors, investors) can work towards better regulation.

|